Contents:

A letter of credit, also known as a documentary credit, is a promissory note issued by a financial institution, typically a bank or credit union. It ensures that a buyer’s payment to a seller or a borrower’s payment to a lender is received on time and in full. Another significant distinction between bank guarantees and letters of credit is the parties who use them. Contractors who bid on large projects typically use bank guarantees. The contractor demonstrates its financial credibility by providing a bank guarantee. Bank guarantees and letters of credit both work to reduce risk in a business agreement or transaction.

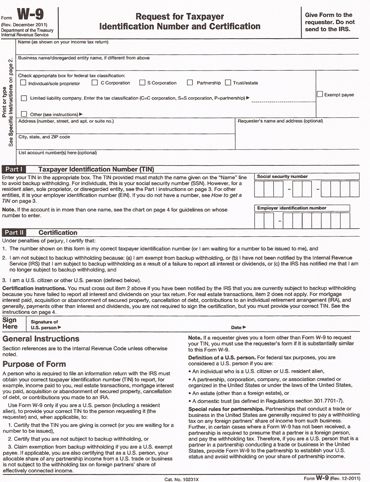

- The format is usually provided by the issuing bank or the beneficiary of the Bank Guarantee/Standby Letter of Credit.

- SBI Australia as an Australian bank are ready to put the weight of our parent’s esteemed global reputation and credit worthiness to support your specific needs through a Banker’s Guarantee, both performance and financial.

- Apart from this, you may also be charged with an application fee, documentation fee, and handling fee, etc.

- This is a good and better way of finance and surety provided by banks to their clients.

- Bank guarantees are often used in real estate contracts and infrastructure projects, while letters of credit are primarily used in global transactions.

LOC is issued by the bank when the buyer requests his bank to make a payment to the seller on the receipt of certain goods or services. A bank guarantee is a commercial instrument guaranteeing by bank to a party on behalf of his customer, assuring the beneficiary to effect payment on default of obligation. A bank guarantee and a letter of credit are both promises made by a financial institution that a borrower will be able to repay a debt to another party regardless of the debtor’s financial situation. ADVANCE PAYMENT GUARANTEE – An Advance Payment Guarantee is issued by the bank when the seller is paid with an advance amount. According to BG terms, if the seller is unable to deliver the goods or services to the buyer as mentioned in the contract, the buyer will be returned or recovered with the advance payment made to the seller. This type of letter of credit is used to assure the seller regarding the financial status of the buyer.

Helps in certifying the credibility of individuals, which in turn, enables them in obtaining loans and also assists in business activities. We can process your Bank Guarantee/Standby Letter of Credit within 24 hours, provided the application and credit limit are in place. Obtain short term financing options for your procurement and sales at competitive terms both under open account and transactions under Letters of Credit.

More Under Finance

Enjoy comprehensive banking solutions that suit the banking need of every MSME. I write articles in various categories, from legal, business, personal finance, and investments to government schemes. I put words in a simplified manner and write easy-to-understand articles. Banks generally charge low fees for guarantees, which is beneficial to even small-scale business.

Khatabook does not make a guarantee that the service will meet your requirements, or that it will be uninterrupted, timely and secure, and that errors, if any, will be corrected. The material and information contained herein is for general information purposes only. Consult a professional before relying on the information to make any legal, financial or business decisions. Khatabook will not be liable for any false, inaccurate or incomplete information present on the website.

Those who would like to have additional information may contact the Bank. The information and materials contained herein including text, graphics, links or other items are provided as is and as available. City Union Bank does not warrant the totality and absolute accuracy, adequacy or completeness of this information and materials and expressly disclaims any liability for errors or omissions in this information and materials herein. A) Bank Guarantees above Rs.1,00,000/- issued in our bank will be duly signed by two authorised officials of the Bank. Bank Guarantees above Rs.1,00,000/- in single signature are not valid. We are regulated by APRA as a foreign bank ADI and operate under an Australian Financial Services Licensed by ASIC.

Bank Gaurantees

The importer approaches its bank to issue a bank guarantee on his behalf to the supplier. If the issuing bank finds the credit history and financial stability of the applicant appropriate, it issues a BG to the importer. Now if the importer makes any default in paying or fulfilling the terms & conditions of the BG contract, the supplier can recover the amount from the issuing bank. The bank here undertakes the responsibility to pay the exporter if the importer is unable to do so. It assures the exporter that they will get their amount for the delivered goods & services to the importer.

A letter of credit vs bank guarantee is a facility offered by banks & financial institutions guaranteeing the buyer that the seller will make payment on time, if suppose he/she fails to make payment. Generally, there are various types of letter of credit offered for international traders. To use this facility, you will be required to meet few eligibility criteria.

Letter of Credit definition: Breaking down the confusion – Trade Finance Global

Letter of Credit definition: Breaking down the confusion.

Posted: Tue, 14 Feb 2023 08:00:00 GMT [source]

We help you manage Forex fluctuations and transform exchange volatilities into opportunities in line with your risk appetite. Through our team of foreign exchange specialists, we can provide a comprehensive range of services for your business. It is instrument issued by a bank at the request of its applicant securing the beneficiary in case of default by the applicant. This type of guarantee is given by a bank to the creditor to pay the amount of loan body and interests in case of nonfulfillment by the borrower. In case of any changes or cancellation during the transaction process, a bank guarantee remains valid until the customer dully releases the bank from its liability.

Security

A revolving letter of credit allows customers to make withdrawals over a set period of time. The purchasing company seeks a letter of credit from a bank where it already has funds or a line of credit . If the supplier fails to deliver cement within a certain time frame, the construction company would notify the bank, which would then pay the company the amount specified in the bank guarantee. The charges that a BG service provider charges for the issue generally depends on the level of risk being borne by them. For example, a Financial BG contains more risks than a performance BG, hence they are expensive and are available with a higher fee.

Pre Lincoln Steve Cotterill – News – Shrewsbury Town

Pre Lincoln Steve Cotterill – News.

Posted: Sat, 06 May 2023 00:27:48 GMT [source]

A standby letter of credit provides both parties with certain advantages. The seller stands to receive his dues, and the buyer benefits in case of a seller default in production, supply on time, or quality control. Confirmed Irrevocable Letter of Credit-In a confirmed Irrevocable L/C, another bank is yet more party which obliges itself to honour the L/C in the same manner as issuing bank.

Types of Letters of Credit

Once the banking officials are satisfied with all the criteria, they will provide the necessary approvals required for the BG processing. Any person who has a good financial record is eligible to apply for BG. BG can be applied by a business in his bank or any other bank offering such services. Before approving the BG, the bank will analyse the previous banking history, creditworthiness, liquidity, CRISIL, andCIBILrating of the applicant.

We understand that for exploring your business overseas, you may need to deal with unknown suppliers. Your suppliers may require payment assurance for doing a business transaction. In this regard, with our Letter of Credit service we can provide payment assurance to your supplier which will facilitate easy purchase of goods. In the situations, where a customer fails to pay the money, the bank must pay the amount within three working days. This payment can also be refused by the bank, if the claim is found to be unlawful.

Fresh drive against fake GST registrations – Times of India

Fresh drive against fake GST registrations.

Posted: Sat, 06 May 2023 00:36:00 GMT [source]

Reassure your buyer or seller of payment with a Banker’s Guarantee/Standby Letter of Credit. In the event that you fail to fulfil your contractual obligations, we will honour payment to your beneficiaries upon receipt of a claim that complies with the guarantee terms. In the case of a standard letter of credit, it is expected that the payments will happen as those letters pay after a successful shipment is delivered to an importer.

It also states that if the buyer can’t make a payment on the purchase, the bank will cover the full or remaining amount owed. The letter of credit ensures the payment will be made as long as the services are performed. Bank Guarantee a promise made by the bank to any third person to undertake the payment risk on behalf of its customers. Bank guarantee is given on a contractual obligation between the bank and its customers. Such guarantees are widely used in business and personal transactions to protect the third party from financial losses.

The BG as an Financial Instrument generally used as a surety and provide confidence of a big or large manufacturer or seller to deal with small and new clients. Since a large manufacturer generally wants a BG from small seller bank to protect its payment in case of dealing with new and small client. A letter of credit (L/C) is a type of “documentary credit” or a “non-fund based credit”. This means that a Letter of Credit is a promise made by the Bank to pay to the exporter / seller on behalf of the importer / buyer. The seller receives the payment only when all the requirements specified in the L/C are met including the documents, delivery dates, product specification, etc.

Payment Guarantee- Protects the beneficiary if the applicant fails to honour the payment under their contract. Our Escrow solutions have been designed to help you compete effectively in the contemporary business environment. Our products target multiple needs including safe keeping, cash and demat escrows and document escrows to name a few. We work meticulously with you to comprehend the challenges and intricacies of your business and provide innovative solutions for efficient management of your working capital. We offer a host of long-term financing solutions to set your business on the fast track to growth.

A BG is essentially used to ensure a seller from loss or damage due to the non-performance by the other party in a contract. LOC is generally misunderstood as BG since they share some common characteristics. They both play a significant role in trade financing when the parties to the transactions don’t have established the business relationships. This type of bank guarantee is used to secure the responsibilities to pay goods and services. While a letter of credit is a similar, the principal difference is that it is a potential claim against the bank, rather than a bank’s client.

Download Black by ClearTax App to file returns from your mobile phone. Sometimes, the banks are so rigid in assessing the financial position of the business. Our suite of online and electronic services cater to all your banking needs, from the simplest to the most complicated.

It is commonly used by contractors in real estate or infrastructure projects in the domestic market. Under an LC, the seller gets guarantee on payment of his sale of goods from the buyer’s bank. I request readers to go through my different articles in detail in this website, already explained. Some contracts may require a financial commitment from the buyer such as a security deposit. In such cases, instead of depositing the money, the buyer can provide the seller with a financial bank guarantee using which the seller can be compensated in case of any loss. Emerio Banque is a legal and private financial institution specializing in international trade finance services, import/ export, letter of credit, and other offshore banking services.

After the goods are shipped, the bank will pay the wholesaler its due as long as the terms of the sales contract are met, such as delivery by a certain time or buyer confirmation that the goods were received undamaged. It also states that if the buyer is unable to make a payment on the purchase, the bank will pay the entire or remaining amount owed. Clients who are interested in one of these documents are thoroughly screened by banks.

This means that a BG proves sound financial position of a client before the world. In case of Performance BG a customer ( government departments, big real estate projects, turnkey projects etc.) may allot work to new contractor on the basis of Performance Guarantee given by his bank. The Bank Guarantee facility is a non-fund based facility and generally there is no outlay of funds of client against whom BG is issued. This is a good and better way of finance and surety provided by banks to their clients. As you are aware that Bank Guarantee is a promise made by a Bank/Financial Institution to any third person to undertake payment risk on behalf of its customers. It is generally issued on request of a customer of a bank/financial institution in favour of third party to protect third party in business or financial transactions with the requesting customer of the bank.

The bank only pays that amount if the opposing party does not fulfill the obligations outlined by the contract. The guarantee can be used to essentially insure a buyer or seller from loss or damage due to nonperformance by the other party in a contract. A bank guarantee is when a bank offers surety and guarantees for different business obligation on behalf of their customers within certain regulations. The lending institutions provide a bank guarantee which acts as a promises to cover the loss of the customer if he/she defaults on a loan. It is an assurance to a beneficiary that the financial institution will uphold the contract between the customer and third party if the customer is unable to do so. A letter of credit is a document issued by bank that guarantees payment for goods or services when the seller provides acceptable documentation.

Depending on the type of BG, fees are usually charged on the BG value every quarter. Apart from this, you may also be charged with an application fee, documentation fee, and handling fee, etc. There are additional risks for the lender in BG service, so these loans are issued with greater costs or interest rates. Once sure about the creditworthiness of an applicant, any bank of NBFC can issue a standby letter of credit. SBLCs are different from LCs because, if so desired, they can contain a performance feature that refers to negative performance.

This type of guarantee is less expensive and is also subject to the law of the country in which the guarantee is issued unless otherwise it is mentioned in the guarantee documents. As the name suggests, letter of credit can be revoked by the issuing bank without the beneficiary’s assent or agreement. An import letter of credit enables importers to make immediate payments by providing a short-term cash advance. Letters of credit, which are financial promises made on behalf of one party in a transaction, are particularly important in international trade. A bank in one country issues it to another bank located in another country. The issuing bank requests the other bank to issue a new standby LC to their local beneficiary.