Qualification requirements – To secure debt financing, you need to have an excellent credit score and history. Simpler budget and finance planning – As you know the exact amount you have to pay, both as interest and principal amount, planning your budget and finance becomes simpler. However, the biggest downside to equity financing is that you will have to share a part of your company with investors.

The tips outlined here will help you stay on top of your small business finances and establish a system that works for you. This amount should be sufficient to cover state and local income taxes, as well as self-employment taxes (however, your amount may vary, so be sure to check with your tax advisor). By setting money aside on a monthly basis, you ensure that you have cash on hand to make quarterly tax payments.

And one of the most fundamental skills and tools for any small business owner is sound financial management. Creating a budget can dramatically alter how you manage small business finances but can also help achieve revenue targets sooner than you might expect. Putting money management tips into practice can significantly improve cash flow management. But sometimes, the unexpected happens, and you’re left needing to cover an emergency expense. Failing to wisely manage money can lead to problems like making late payments, running out of money, and not collecting on your accounts receivable. Setting up your business finances is a crucial part of setting your business up for success—but if you don’t know where to start, the process can feel confusing, frustrating, and downright overwhelming.

Once you get the details figured out, you can have a better look at your financial health, and file an airtight tax return by the end of the year. This is a great way to ensure that you are not overspending on unnecessary costs and will help you budget for the future without having to take and pay off large loans. PlanGuru includes an integrated balance sheet, cash flow statement, and income statement, but its capabilities don’t end there.

Free: Business Plan Template

But from this, only two-thirds of businesses are able to stand for three years, and only half survive more than five years. Small businesses are equally complicated in comparison to Large scale businesses. Just establishing the business and working blindly is not the way to success. This ratio is a measure of liquidity and indicates your ability to pay short-term liabilities. Not only will this assist you in resolving financial issues, but it will also help in saving a significant amount of money in the long run. For a more in-depth look at the different types of financial professionals, how they can support your business, and how to find the right pros for you, check out Gusto’s guide to financial pros.

Remember that 38% of small businesses fail because they run out of cash. If your business depends heavily on invoicing, you need an organized system for invoice tracking Debits and Credits Normal Balances, Permanent & Temporary Accounts and driving collections. Find a digital solution to help you generate invoices, track them, stay ahead of collections, and accept payments from customers.

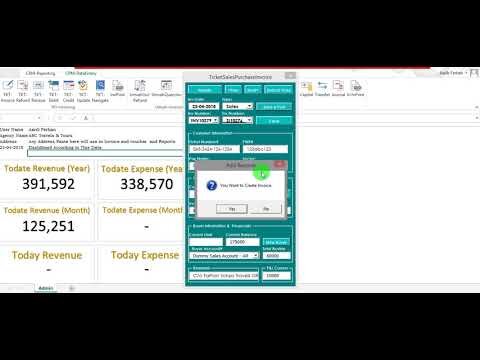

Free tools are available for tracking cash flow to help you manage your finances more efficiently. Through debt financing, you can quickly access capital that you might not otherwise be able to get for weeks or even months. Bank loans, government loans, merchant cash advances, business credit lines and business credit cards are all forms of debt financing, which you must repay even if your company fails. The next thing for managing small business finances is to invest in technology and understand all the terms related to your business in order to maintain the number 1 position in the business market. Sometimes, it is better to use online software for keeping the records of your finances and accounts and establish an online presence in order to attract more customers.

How efficiently does your business convert money invested in assets into profits? To benchmark, compare against others in your industry, as this will vary depending on what type of business you have. Higher net profit margins indicate that your company is efficiently converting sales into profit. Comparing against peer companies will help you create benchmarks and goals.

A budget also forecasts the amount of revenue your business will receive. If you find that your revenue is lower than budgeted, find ways to cut expenses and increase income. When you know how much you can spend, you can more easily manage your spending money. And, wait until you have enough cash on hand to cover new expenses.

There are two accounting methods small businesses can use—cash and accrual. You’ll need to pick a system before the end of your first tax year and then stick to it every year following. If your business started as a side hustle, you may already have some preliminary sales data. Even a few numbers can help you figure out which of your products are bestsellers and what times of year your sales will be high or low. There most likely will be other businesses out there offering products or services similar to yours. Research some of them to get a sense of how they’re pricing their items.

Understand your business funding options

Whether you use Excel, online small business accounting software, or good old-fashioned pen and paper, you’ll need to choose a system that makes it easy for you to enter every sale and purchase. At minimum, you need to track amounts, dates, vendors, and clients. If your business is small and you’re not making a lot of transactions, single-entry is the simplest way to keep your books. In this method, entries are recorded a single time, marked as either an input (revenue) or an output (expenses), while things like inventory and working capital are tracked more casually.

Dealing with paper records can quickly become unorganized and overwhelming for any business owner. It is important to try and digitize as many financial records for your business to help you stay organized and ensure that you can quickly access your financial documents. Once you have saved your documents digitally, it is best to invest in a secure third-party service to ensure that they are protected.

How Important Is Efficient Financial Management for Small Businesses?

It’s an indicator of how well you’re using capital to generate sales. Following are some tips for managing a small business in a smooth manner. Think of your startup budget as a financial roadmap; it lays out where you are, where you want your business to go, and, from a financial perspective, how to get there.

- Embezzlement and wasteful spending can happen right under your nose.

- Looking closely at money-in and money-out helps maintain a sustainable balance between profit and loss.

- Online expense management, similar to issuing automated invoices, also saves you time and money by capturing all expenditures into one place for easy monitoring and financial reporting.

- Before joining LendingTree, Kurt spent a past life as an academic, studying U.S. history.

Whether your small business operates with or without a specialized accounting team, efficient bookkeeping will save you time and money. Sure you could keep everything in a spreadsheet, but that might get unwieldy. There are a lot of free and low-cost accounting programs available and they will save you headaches down the road. QuickBooks, Wave, Zoho Books, Xero, and FreshBooks are a few examples of the best apps for small business owners. Your business credit score impacts everything from qualifying for business credit to landing contracts and the rate you’ll pay for business insurance. The balance sheet shows what your business owns (assets) and owes (liabilities) at a specific point in time.

Tips for managing small business finances

Or you can define a fixed salary amount that becomes a part of the company’s recurring expenses. It’s very tempting to put all your earnings straight back into your business without compensating yourself for all your time and hard work. This is a mistake many startup entrepreneurs make when not paying themselves a salary.

The first will give you a place to manage your day-to-day revenue and expenses, while the second can be used for setting aside money for things like taxes or future investments in your business. The underwriting process at traditional banks can be clunky and obscure. Through Shopify Capital, merchants can get funding within days of being approved. Once merchants accept an offer and it is approved, funds are deposited in as little as two days and loans can be repaid as they make sales. You could use the loan to fund payroll, inventory, marketing campaigns, or other things that can fuel your businesses growth.

In comparison to personal cards, corporate credit cards have higher credit limits which facilitate managing all expenses for small businesses without having any impact on personal liability. Small business financial planning consists of accounting, budgeting, tax preparations, future forecasting, and risk administration. To maintain the accountability of a company’s financial team, ensure the coherence of the financial and accounting statements, and be secure from fraud, internal controls are executed by a company. The duration of a business loan is variable and could range from one week to five or more years, and speed of access to funds will depend on the lender’s internal processes.

Cash flow is defined as the growth or decline in the amount of cash a business or an organization or sometimes even an individual possesses. All the components discussed further are constant throughout all industries and specific to business financing. The information gathered can only be useful if your inventory management practice is efficient and up-to-date.

You have to keep a sharp eye on your business performance and the financial conditions to make the right decision while taking a loan. Good business financing is about taking care of even the tiniest details. By discarding the complexity, you can save a lot of time and identify the hidden costs which make the whole thing unnecessarily expensive. For reaching a profitable output every year, you need to have some plans and strategies in place to help your company reach that target. Ordinarily, companies hire CPAs or tax professionals to look over their tax return files, but we would suggest you personally analyze your tax file. Every different stratum of your business structure has a different kind of tax return attached to it.